Magnolia Federal Credit Union and Swaystack Turn Onboarding Into Engagement That Lasts

Magnolia FCU partners with Swaystack to increase member engagement and loyalty with gamified onboarding.

With Swaystack, we can present members with actionable items like adding direct deposit, opening a checking account, or applying for loans, which will increase engagement and member loyalty.”

MIAMI, FL, UNITED STATES, November 12, 2025 /EINPresswire.com/ -- Swaystack today announced its partnership with Magnolia Federal Credit Union (Magnolia FCU) to transform how new members are welcomed, guided, and retained.— President and CEO Michael Waylett

The Mississippi-based credit union, led by President and CEO Michael Waylett, saw an opportunity to strengthen early member engagement inside its existing digital banking experience. Like many community institutions, Magnolia FCU wanted to move beyond account openings to build deeper connections, turning first deposits into lasting relationships.

For many community institutions, acquisition is not the issue. Activation is. Magnolia FCU’s digital growth revealed a familiar challenge: new members were opening accounts but not engaging beyond day one. Without a clear path toward funding, setting up direct deposit, or exploring digital tools, members were drifting away before forming habits of trust.

“There’s no more momentous time with a member than at the time of account opening. Often, they’ll never forget how those first interactions felt and how the onboarding process was handled. Unfortunately, Magnolia had a very antiquated process for onboarding new members that was wonky and impersonal”, said Michael Waylett, President and CEO of Magnolia FCU. “With Swaystack, we’ve been able to present new members with actionable items like adding direct deposit, opening a checking account, or applying for loans, which we are confident will increase engagement and member loyalty.”

Swaystack’s platform builds trust into the onboarding process itself, connecting digital banking, lending, and marketing teams around shared outcomes.

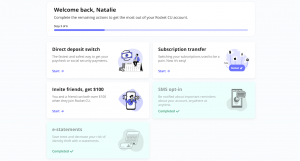

For Magnolia FCU, that meant launching personalized journeys for:

• New Checking Accounts — driving direct deposit setup, e-statement enrollment, and cross-sell opportunities

• Indirect Members — introducing the credit union’s full suite of services after loan funding

Integrated directly with Banno Digital Banking and Origence SSO, these onboarding experiences now deliver real-time prompts, rewards, and progress tracking, guiding members through the habits that matter most.

Credit union leaders understand that early engagement predicts lifetime value. Yet most first-year attrition happens in silence, not from dissatisfaction, but from uncertainty. Swaystack’s data shows that when members complete just two key onboarding milestones, such as funding an account or switching a direct deposit, retention rises by more than 30%.

“Magnolia FCU understood something fundamental,” said Har Rai Khalsa, CEO and co-founder of Swaystack. “Onboarding isn’t a formality; it’s the moment a member decides if you’re their financial home. The first 30 days are a window of truth. When you lead with purpose, you don’t just keep the account; you grow it. You earn the relationship.”

Magnolia FCU’s fast path from discovery to launch, in just seven weeks, shows what’s possible when credit unions act decisively to modernize the member experience without losing their human touch.

The partnership stands as a blueprint for other community institutions looking to activate new accounts faster, strengthen primary relationships, and convert first impressions into long-term loyalty.

About Swaystack

Swaystack, a personalized engagement platform, is spearheaded by second-time founders who share a passion for helping banks and credit unions compete with megabank and neobank technology. Har Rai Khalsa began his career as a lender in 2007, co-founded MK Decision in 2015 to help banks and credit unions compete with digital account opening, which was acquired by Alkami in 2021. Simran Singh Co-founded Zogo in 2018. As the CTO of Zogo, he helped 250+ financial institutions gamify financial education to over 1.1 million users. Simran and Har Rai have a collective 20+ years in fintech and have served over 300+ financial institutions with the companies they’ve built.

About Magnolia FCU

Magnolia Federal Credit Union is a member-owned financial institution dedicated to serving individuals, families, and businesses across Mississippi. Founded on the principles of community and trust, Magnolia FCU provides a full range of financial products and services—including checking, savings, loans, and digital banking—designed to help members achieve their financial goals. With branches in Jackson, Gluckstadt, Flowood, Morton, and McComb, Magnolia FCU continues to build lasting relationships through personalized service, local decision-making, and a commitment to empowering financial well-being.

Har Rai Khalsa

Swaystack

email us here

Visit us on social media:

LinkedIn

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.